At some point, you’ve probably seen charts that compare the cost of buying a home versus the cost of renting. These are often designed for first time homebuyers, to see which option makes more sense. They take into consideration ongoing carrying expenses such as property taxes, insurance and HOA dues, along with the projected monthly payments on a loan.

One major feature that these comparisons usually do not show is that ownership protects the owner from inflation. For example, let’s say that the comparison is for a renter who is paying $5,000 per month in rent and wants to see what $5,000 per month will buy, instead. Often times in our area the rental price will “buy” more home than a $5,000 budget for ownership. This can dampen a renter’s enthusiasm for wanting to buy. However, what the comparison is usually not showing is the likely inflation of rent values and home values over time, compared to a fixed rate mortgage.

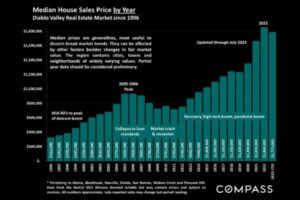

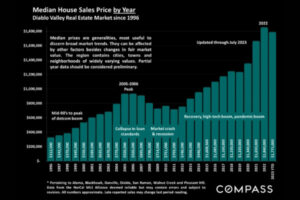

With a fixed rate mortgage, the cost of $5,000 can stay fixed for 30 years. While there are no guarantees for where prices will go in the future, we can learn from the past. If we look back about 15 years, the home that is renting for $5,000 today, was renting for about $2,500. Go back 30 years and the same home was renting for about $1,400. It’s a pretty safe bet that rents will continue to rise and that home values will increase over time.

The renter who chooses to buy today, instead of continuing to rent, can opt for a fixed rate loan and “lock in” their housing expense for the next 30 years. Of course, if interest rates drop significantly, they will likely choose to refinance their loan and end up with a smaller payment. Either way, they have the security of a fixed payment that will not go up with inflation. The ultimate benefit is that once the loan is paid off, the homeowner will no longer have a monthly payment to make and will only be paying property taxes, insurance and maintenance. The renter who chooses not to buy will likely find themselves paying significantly more in rent, in the future. In addition, they will not have the opportunity to build wealth through equity in a home.

The homeowner will enjoy the benefits of being able to improve and customize a home to their own taste. They’ll also enjoy being in control of timing, should they wish to make a move, versus the renter who has to wonder if their landlord will renew a lease each year and/ or how much the rent will go up!

Every buying situation is unique. Please feel free to reach out to me at 925-964-5010 or via email at Lisa.Hopkins@Compass.com for a custom analysis of your options and the timing that will likely bring you the best results. Even if you’re not ready to buy today, it’s never too early to start planning for success.